Nexteer

About: Listed on the Hong Kong Stock Exchange since 2013, US-based Nexteer Automotive is a leading manufacturer of steering and driveline products. It is the world’s fourth largest supplier of steering parts by market share and serves over 50 major automakers globally.

The Challenge: Prior to 2015, Nexteer’s three onshore entities in China relied heavily on US dollar (USD) intercompany loans from its treasury headquarters to support day-to-day operational needs. As a multinational corporation (MNC) operating in China, each onshore entity was subject to a limit on the amount of debt that it could borrow from foreign-based entities. This created inefficiencies in funding the business as well as challenges to Nexteer’s ambitious expansion plans in China.

The opportunity for Nexteer to revisit its cash structure came in 2015, when the China State Administration of Foreign Exchange (SAFE), as part of the Chinese government’s push to liberalise the financial industry, relaxed its rules around foreign debt quotas. Nexteer hoped to leverage the easing regulation to create a centralised treasury structure and achieve greater cost efficiencies.

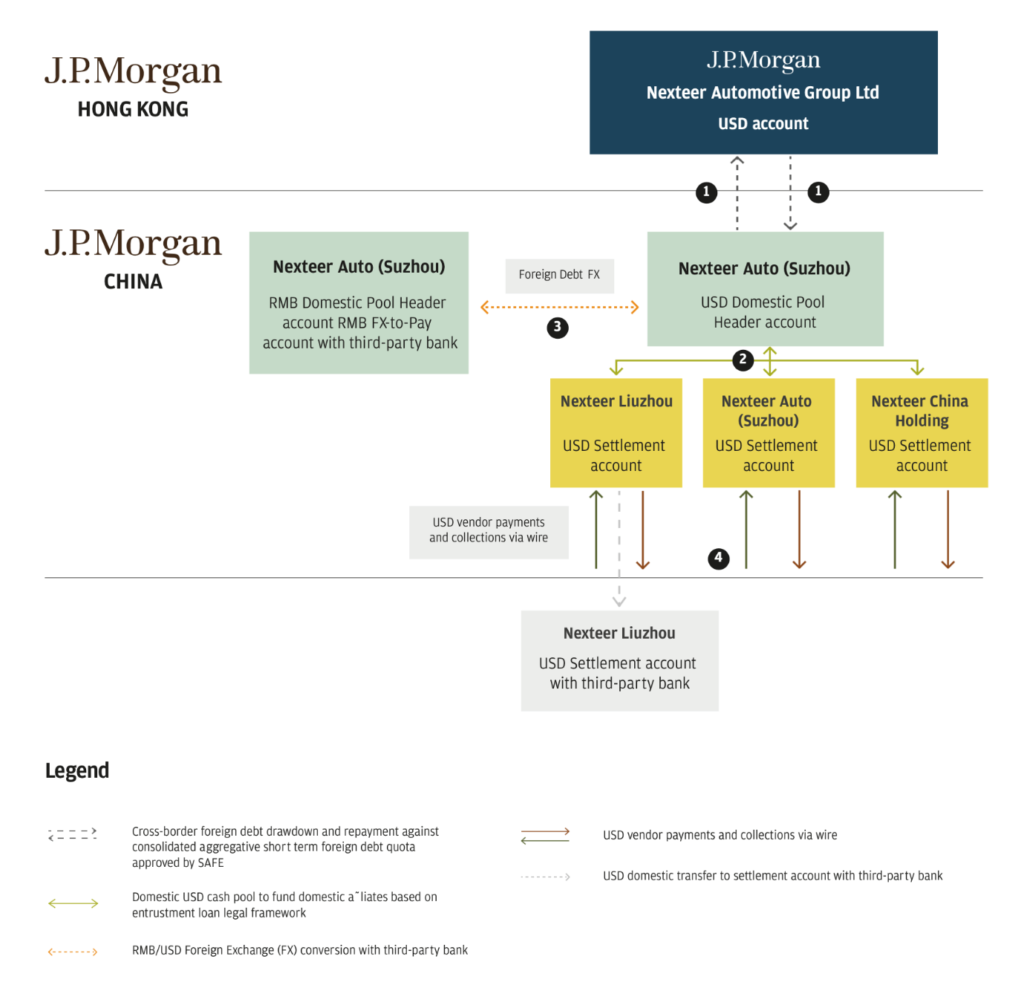

The J.P. Morgan Solution: Nexteer chose to partner with J.P. Morgan for the bank’s wide spectrum of product capabilities and deep understanding of Nexteer’s business. J.P. Morgan, in close collaboration with Nexteer and its local banking partner Bank of China, designed a USD cash pooling structure for the auto part maker’s operating entities and holding companies in China. It also secured approval from SAFE and implemented the solution within a short period of time.

The solution was tailored to Nexteer’s unique business needs and cash management objectives and yielded several benefits:

- As head of the cash pool, Nexteer Auto (Suzhou) – Nexteer’s holding company in China – can borrow from headquarters and offshore entities against a consolidated short-term foreign debt quota of its onshore entities

- All three onshore entities in China can consolidate their cross-border foreign debt quota into Nexteer Auto (Suzhou) as the lead company

- Nexteer can facilitate day-to-day USD operating needs through the arrangement of a USD domestic physical cash pool for its entities based on an entrustment loan framework for two-way domestic sweeps

- Nexteer can further optimise capital by lending any surplus funds to its offshore entities through the lead company

The strong support from J.P. Morgan ensured we received timely approvals from the regulators to implement a robust cash solution that allows us to access foreign funds in the most convenient and cost-efficient manner.

Jane Li, Treasurer, Nexteer Automotive China

The Result: The close partnership between J.P. Morgan, Nexteer and its local banking partners, together with the effective communication with SAFE, ensured that regulatory approvals were obtained in October 2015 – within one month of Nexteer’s application submission. Nexteer’s cash pool solution subsequently went live in November 2015.

The solution enables Nexteer to better utilise its foreign currency capital, obtain funding at a lower cost to improve cost efficiencies and ensures high capital utilisation of surplus funds.

The unique structure will serve as a strong foundation for Nexteer’s cash management operations as the firm continues to expand in China.

TMI View: This is proof that innovative solutions can spring from many sources, even regulatory authorities. Nexteer’s USD cash pooling structure has been engineered to leverage the changing regulatory environment around foreign debt quotas in China – and in doing so has provided the firm with several immediate and longer-term benefits.