Checking Out the Future of Shopping

Five Trends Impacting Payments

By Eleanor Hill, Editor, Treasury Management International (TMI)

Corporate treasury departments are increasingly being called upon to enable new, digital forms of commerce for their consumers and suppliers. This includes embracing real-time payments, digital wallets, pay-by-bank solutions, and virtual accounts. Here, Manish Jain, Global Head of Consumer & Retail Industries, J.P. Morgan, explains how treasurers can lay the groundwork for the future of shopping – by building agile and modern payments infrastructure – and help their business to gain a competitive edge.

Manish Jain, Global Head of Consumer & Retail Industries, J.P. Morgan

The global pandemic, and subsequent lockdowns, gave rise to a period of rapid and significant digital transformation in the world of shopping. This was a trend waiting to happen, according to Jain. “Even pre-Covid-19, digital channels were growing at a higher rate than physical channels, but the share of the pie remained relatively small. The pandemic swiftly became the trigger that forced digital channels to become mainstream. And even as the world emerges from Covid-19, digitisation and automation will continue to increase, given workforce shortages, continued disruption in supply chains, and inflationary pressures on the economy.”

In other words, the pandemic served to achieve, in a matter of months, the digital progress that the retail industry had been working towards for years. In turn, this led to changing business models; which started with direct-to-consumer (D2C) models and evolved into digital marketplaces, expanding the nature of global consumer commerce.

Now, the B2B segment is going through a similar transformation. Traditionally, large corporates sold to small retailers through distributor networks and the whole order management process was manual and tedious. The sales process was driven by sales representatives on the ground. And understanding the demand across multiple complex stock-keeping units (SKUs) and providing intelligent suggestions was challenging to say the least.

Today, with the shift towards the digitisation of B2B commerce, data is captured at a retailer level, meaning that the large supplier can look to provide automated reminders to small retailers about when to replenish their stock, for example, or which new products might work for them. “Growth of B2B marketplaces is here to stay as a long-term trend, offering the potential to significantly improve traditional workflows between buyers and suppliers, with real automation benefits for both parties,” comments Jain.

What this development points to is a larger trend – namely that the experience itself is now a driving force of commerce. “It’s not just about transactions; it’s about how the buyer feels around the interaction,” explains Jain. “Payments are an important part of that experience – they have to complement emerging shopping models, be 24/7/365, and be part of an omnichannel experience. In addition, payment processes must take into account different cultural and geopolitical aspects in terms of which methods are available and popular, or emerging, in each country.”

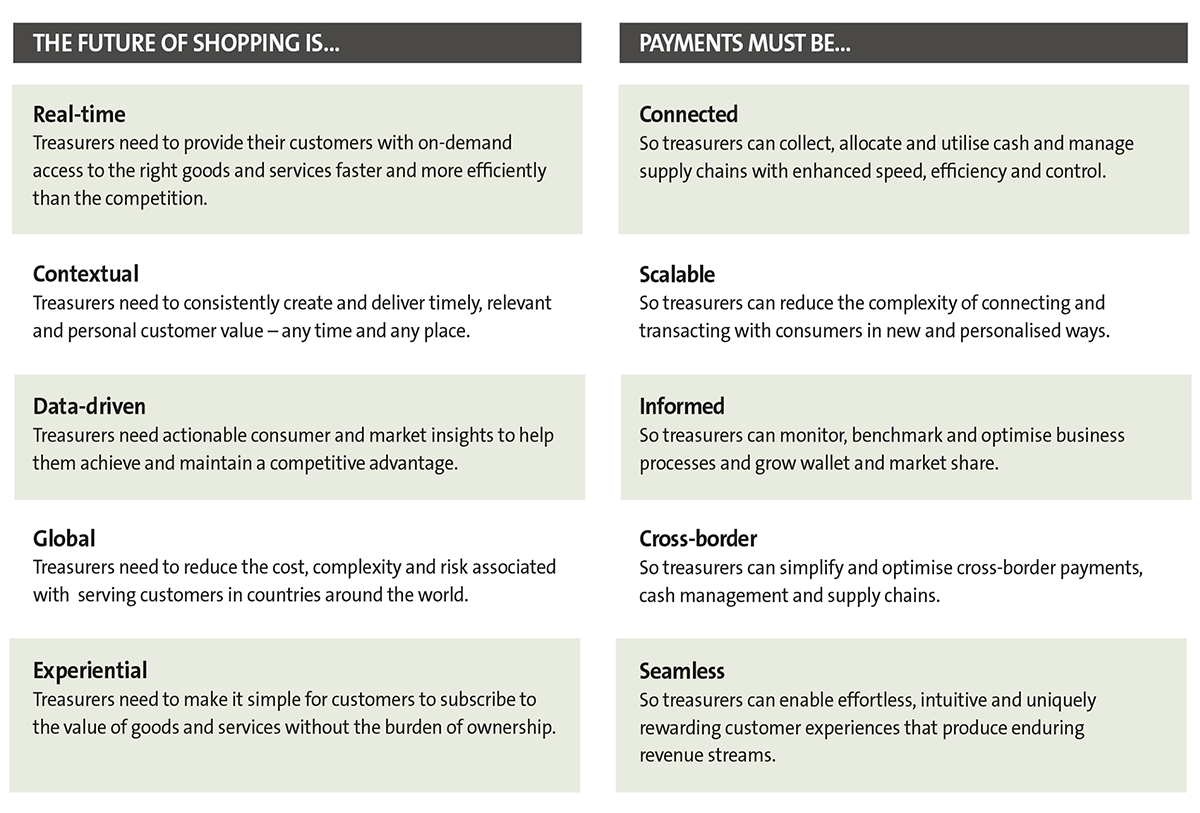

A broken payment experience could result in the loss of sales and, more than likely, the permanent loss of a customer. As such, it is important for treasurers to grasp the latest e-commerce trends, and understand how they can support these shifts by building an appropriate payments infrastructure that makes the customer experience seamless. Indeed, this is one of the five key trends that the J.P. Morgan Payments team has identified around the future of shopping (see table 1).

Table 1

Getting real

Another critical aspect of the emerging e-commerce ecosystem is the ability to access goods and services on demand, and to have them shipped either same-day or next-day. Speed is of the essence, and payments and collections must reflect this, through real-time rails.

Jain has seen growing interest in instant payments among treasurers across the globe. “Volumes are increasing significantly. Interestingly, however, corporates are not simply replacing the regular ACH [automated clearing house] or wire payments with instant payments lock, stock and barrel. Rather, they are looking at specific use cases and leveraging real-time payments where appropriate to deliver a good experience.”

Take the example of gig economy workers, such as ride-share drivers and food delivery agents. “Traditionally, these workers would be paid every two weeks or so. In this kind of economy, that’s no longer sufficient. They want to get paid the moment they’ve completed the service that was delivered – and instant payments enables that.”

In addition to wider use cases, the value limits on real-time payments are also increasing, with the US moving up to a $1m limit per transaction for same day ACH in April 2022.

The collections side of financial workflows is also benefitting from instant payments, where the pay-by-bank model is becoming popular – especially in countries where people are not habitual users of credit cards, or economies where customers do not have cards, such as China or India.

“Enabling customers to pay directly from their bank via real-time rails, either using QR [quick response] codes in Alipay, WeChat or UPI India, delivers an easy real-time experience for the customer. And for the seller, there is finality of payment and instant settlement, as well as reduced risk of fraud. But once, again, it is about combining the right experience with the technology and the payment channels to deliver the desired benefits – customers cannot be expected to input their bank details during the checkout process, for example. It needs to be easy and seamless,” comments Jain.

Adding context

As well as being real-time and centred around a great experience, to adapt to the future of shopping, payments must also be contextual. In a nutshell, this relates to the incidental shopping that happens as we go through our daily lives, rather than the deliberate act of browsing a website for a specific purchase. “Contextual shopping happens when you’re going about your everyday activity,” explains Jain. “Imagine that you’re streaming a video from your favourite influencer and you like the shirt they’re wearing – and there’s a buy button next to it that you can simply click and the shirt is ordered. The next day, the shirt arrives at your home,” he says.

“Or imagine that you’re a passenger in an electric vehicle [EV] and there’s a service station three miles up the road. You can ask the car’s interface what the menu is at the food outlet at the service station, and you can order your meal through the connected car. When you get to the service station and pull into a bay to charge up your EV the food is ready for you – and the payment has already been completed, seamlessly via the connected car.”

The key points around the payments in these examples are that they are incidental, a hidden part of the shopping process, and also extremely convenient. “Contextualised payments will likely become the norm for everyday expenditure, both in the physical world and in the metaverse,” believes Jain.

Solutions are emerging to assist with this seamless payment process, such as digital wallets. “Let’s take the earlier example of the ride-share driver. If they have 15 different rides every day, and get paid after each one, that will mean hundreds of transactions showing up in their bank account each month. Wallets can be used to store up the value from those individual transactions, and the driver can simply cash out when they want, transferring value across to their bank account. This makes it much simpler for the driver.”

This is just one example of wallet usage – they’re also becoming popular on marketplaces, and as a means to incentivise buyers through promotions. As usage grows, increasing numbers of treasurers may find themselves asked to deal with digital wallets, so it’s important to be aware of the implications.

According to Jain, these include the:

- Desired structure for holding the wallet(s) – whether through money transmission licences in various US states and European countries, or through a provider that can take care of this via an out-of-fund flow model

- Security and safety of the wallet provider

- Quality of reporting and reconciliation information available from the wallet provider

Jain says it is also worth investigating the support structure around the wallet offering, such as APIs, AI services including analytics, and accounting. These additional elements are increasingly important in a data-driven world. As a result, digital payment and collection methods must be as informed as possible, delivering insightful information to the treasurer at the touch of a button.

The J.P. Morgan Payments team has also extended the wallet offering to include banking-as-a-service. “With embedded banking functionality, the wallet can offer digital banking, which is an extension of a wallet providing all electronic retail banking services with its own routing numbers. This is especially helpful for overseas counterparties, for ease of doing business internationally and also reducing the cost and inefficiencies of cross-border transactions. They can receive their sales proceeds in these wallets and pay their local bills and local taxes from them – without the need to open a non-resident account in the target country.”

Data reporting and reconciliations

As business models continue to evolve at breakneck speed, the addition of new sales channels across digital and physical routes creates specific issues with respect to managing the data from a sales reporting, accounting and reconciliation perspective. “Treasury has to deal with multiple counterparties and platforms, which creates unique challenges and opportunities to automate how to absorb the data from a reporting and accounting perspective,” explains Jain.

“Solutions such as virtual account management become the key to success in such scenarios,” he believes. This could provide the agility and efficiency that business partners require from treasury, while providing the automation and efficiency needed from a management reporting, finance, and controls perspective.

“The modern shopping experience involves multiple service providers that form part of an ecosystem. Each will have their own reconciliation process and reject codes and so on. That’s extremely complex and time consuming for treasurers. Instead of opening hundreds and thousands of accounts for each of these service providers, in each country or currency, corporates can simply open virtual accounts through self-service platforms and manage the structures as per their need.”

With this solution, the money sits in one account with multiple virtual account structures beneath, but the funds can be categorised by different service providers, stores or e-commerce sites, for example. It’s also possible to view the money by product, regions or business units. “This clear visibility and reporting functionality makes it much easier to reconcile funds. Furthermore, the treasurer no longer has to set up complex sweeps – and yet they still have many benefits of a regular account,” says Jain.

The role of APIs

One of the technologies enabling the use of instant payments and real-time treasury more broadly is APIs. “Traditionally, treasury has been heavily batch orientated. But APIs provide the ability for an on-demand transfer of value, on-demand payments, as well as on-demand query of information and account balances. As such, APIs are becoming a key ingredient in the future of shopping, payments, and treasury as they enable corporates to run their business and move their money when and how they want.”

Cross-border challenges

With digitisation providing borderless sales opportunities, naturally cross-border challenges are becoming more obvious from a treasury and risk perspective. These hurdles include regulatory and reporting burdens, awkward cut-off times, fluctuating FX rates, and deductions. “As shopping models evolve to be 24/7, all of these challenges are exacerbated,” admits Jain. “But it is not all doom and gloom – a number of new cross-border payment tools are emerging, from traditional financial institutions and fintechs, to meet this evolving need.”

For example, the Onyx arm of J.P. Morgan Payments, has created the largest blockchain-based global network solution that enables exchange of information across participants instantaneously, reducing compliance query resolutions. This network also offers validation services, where clients can validate the beneficiary account information across the globe, reducing the fraud and operational risks. J.P. Morgan utilises its proprietary blockchain network to support real-time 24/7 global money movement within branches, eliminating the inefficiencies of traditional cross-border transactions.

The idea here is to create a network of banks enabling real time money movement across banks globally. To this effect, J.P. Morgan has also co-founded the Partior network in Singapore, alongside DBS Bank and Temasek. This blockchain platform, which was launched last year, aims to improve the speed and reduce the costs of cross-border payments across the network banks with an initial focus on Singapore dollar and US dollar payments.

“We are working with local regulators across the globe, other banks, and fintechs alike to reduce the number of intermediaries in cross-border transactions, thereby reducing the risk of payment rejects and cut-off challenges. It’s about ensuring payments are frictionless and low cost in the future, even between far-flung geographies.”

Preparing for change

While the future of shopping continues to evolve, what’s certain is that digital progression will keep happening. “As such, treasurers in both B2C and B2B sectors must adapt to this real-time environment and embrace techniques such as instant payments, virtual accounts, and APIs, integrating them into their everyday infrastructure,” says Jain.

“Given that the shopping experience is also becoming so vital to customer retention, treasurers must also ensure that they are at the forefront of new shopping models. That includes the ability to design a payment experience that matches the new shopping model.”

Treasurers must also stay true to their risk management roots and work to carefully evaluate any new financial partners that are brought in to assist in embracing innovations in shopping and payment channels, believes Jain.

“Now more than ever, the treasurer must have a seat at the decision-making table, and work to make their voice heard. An agile and modern payments infrastructure is vital for survival in uncertain times and thriving in the future – and the treasurer sits at the heart of this transformation.”