Predicting the Future – 5 Treasury Megatrends for 2022

The past 24 months have been anything but predictable. Yet, beneath the Covid umbrella, the world continues to turn, and progress marches on – especially in the area of transaction banking. But how can treasurers assess the latest industry innovations and sort genuine trends from hot air? Julie Lubell, Global Head of Trends & Intelligence Advisory, J.P. Morgan Payments, has the answers.

Business success depends on many factors. Chief among them is the ability to accurately anticipate, and adapt to, the megatrends of today and tomorrow. Unlike trends in the fashion world, or certain financial markets, treasury megatrends are neither whimsical nor transient. They are the forerunner of progress and innovation, as well as a cornerstone of business sustainability, in every sense of the word.

Being a successful treasury trendspotter therefore requires a combination of knowledge, insight, creativity, curiosity, strategic thinking, and a healthy dose of scepticism – all of which Lubell has in spades. A self-confessed “geek”, she spends her days reflecting on the past, analysing the present, and extrapolating to the future.

reflect on 2021. “During the early part of last year, many commentators were hoping for a V-shaped economic recovery as Covid-19 looked to be abating. But soon enough, the Delta and Omicron variants threw spanners in the works, alongside supply chain disruptions, and geopolitical tensions. All this added up to huge uncertainty and an uneven recovery.”

BOX 1 – Megatrends: Much more than a number

- Digital as a culture

- Anything-as-a-service

- Payments as a revenue driver

- Aligning working capital and liquidity

- Addressing ESG agendas

The initial expectation of a V-shaped recovery was pinned on the growth of eCommerce, which also highlighted the greater gap between those who capitalised on the shift to global online buying behaviours and those left behind. The laggards’ inaction is either due to inertia, unwillingness to change, or lack of budget to facilitate a rapid pivot towards digital channels.

Thankfully, for the laggards, 2022 presents another opportunity to join the digital transformation journey. Before digital was siloed and a ‘nice to have’ agenda item – fast forward to today, digital is a strategic “must have” that needs to be aligned and integrated holistically across an organisation. To capture the true value of a digital experience, digital needs to be integrated across every component of the value chain.

Achieving this integrated level of digital thinking (and doing) will, however, require work – regardless of where an institution currently stands in its digital journey (see box 2), says Lubell. “To reap the full rewards of ‘digital’, it must be embedded into every aspect of the value chain, end-to-end,” she explains. “Before, the focus for digital was only on customer engagement. Now, it extends beyond the UI – it needs to be embedded into your payments process, supplier engagement, operations, technology, and controls. All of these functions need to connect together with one digital agenda.”

BOX 2 – Stages of digital readiness

There are typically three broad stages during a client’s digital journey, explains Lubell. First is the discovery stage, then comes the transformation stage, which progresses onto the visionary stage. “The majority of treasurers we work with are now at the transformation stage, meaning that they are no longer operating in a fully paper-based manner, but they’re also not fully electronic by any means.” Lubell shares that clients are typically moving much quicker from the discovery through to the transformation stage, with the majority of J.P. Morgan clients building towards their ‘visionary’ stage. However, she also points out that the ‘visionary’ stage will keep evolving with technology, noting there really isn’t a true ‘end state’.

For many organisations, this means thinking beyond customer engagement. Digital needs to be embedded into and interwoven across your payments process, supplier engagement, operations, technology, and controls. All of these functions need to connect together with one digital agenda. As Lubell elaborates, however, “A company doesn’t have to be a digital native to become digitally forward. Neither does a person, for that matter. Digital capabilities can be learnt and cultivated, and ultimately embedded into the organisation’s DNA.”

Embracing digital as a culture through data

Another element to an integrated digital strategy across an organisation is their data. “As ever, treasurers are looking for visibility and clarity,” Lubell notes. A digital culture can help deliver a firm grip on cash positions, as well as real-time data for strategic decision-making. “It’s about building a digital ecosystem with data as a connector, rather than digital and data islands within treasury,” she says. “So, where treasurers may be used to disparate TMSs and/or ERPs as well as portals, now they can use APIs to have real-time data delivered directly, in a fully automated manner, into a system of their choice – creating a single source of truth.”

The instant capabilities that come with a digital culture can also lead to competitive advantages, she believes. Take gig economy workers, such as ride-share drivers, for example. “If the drivers are paid in real time, they can then refuel their cars and carry on working for longer, leading to greater revenues for the corporate and an increased pay packet for the employee. Instant payment for work undertaken also encourages workforce loyalty and improves wellbeing,” comments Lubell.

Of course, the ability to pay workers instantly is derived from the capacity to collect from customers in real time (more on this later). “Thanks to digital connectivity and embedded payments, ride-share cars have become wallets on wheels,” quips Lubell. “The vehicle is no longer just the means of delivering the service, it’s also a tool for collecting data and moving money. That’s the kind of empowerment that a digital culture enables.”

The ‘anything-as-a-service’ economy

Being digital end-to-end also provides the bedrock for a world where embedded finance rules. This development, also sometimes broadly referred to as Banking-as-a-Service (BaaS), is part of the second megatrend identified for 2022, namely ‘anything-as-a-service’. Lubell confesses that this is her “absolute favourite trend” and she sees it redefining the current era of innovation.

But what exactly is it and why should treasurers pay attention? “Treasury professionals will be familiar with the concept of Software-as-a-Service [SaaS], whereby their TMS is delivered via the cloud and no longer held on-premise. But BaaS, and the wider trend of anything-as-a-service is a slightly different idea, built around business partnering,” she notes.

Lubell explains that there are two ways anything-as-a-service meets the changing needs of customers and businesses today. One, as a niche solution which meets the specific needs of the customer and business while enabling flexibility. Two, as a single platform which results from a pivot to ecosystems created by knitting together various niche as-a-service solutions.

BaaS really focuses on connecting everything into that one single platform. Essentially, banks enable customers to embed financial services, via APIs, into their own offerings or channels. Acting as a single connector, BaaS weaves together all the offerings on a platform for one simple user experience.

The rationale here is simple: companies are looking for ways to extend their reach beyond their core competencies, improve the customer experience, drive up customer retention, and ultimately grow revenues – meaning more cash coming in for treasury to handle. “And by partnering with a bank – a regulated entity – rather than working across multiple partners, the organisation can achieve these multiple goals in a manner that is cost-effective, secure, and strategically sound,” notes Lubell.

But as a result of such partnerships, the lines between banking and other industries are blurring. The potential of the as-a-service model is therefore starting to switch on lightbulbs in the heads of company leaders in a variety of sectors. “Let’s stick with the car theme and take automobiles as an example,” says Lubell.

“Before, to drive a car, you needed to buy a car. Now, some auto-makers have come out with monthly subscription plans where you can drive a new car every month without purchasing. This opens doors to a whole new market of drivers who want to be users and drivers, but without commitment to one vehicle model or style.”

There is also the capacity to deepen the relationship between the as-a-service partners by leveraging data to tailor the service provided, continues Lubell. For instance, the manufacturer could leverage the insights and drivers’ behaviour to provide personalised recommendations and also create a new revenue stream by sharing data with insurance companies and retailers. Personalised recommendations, should the driver enrol, could include alerting the driver to when the car needs to be serviced, where they can pick up their daily coffee, or even if they’re passing a local store which carries the toilet paper they use.

This simple example explains how mobility-as-a-service could work, but the concept can be applied in different scenarios across numerous industry verticals. “I believe that treasurers will hear about anything-as-a-service more and more in 2022 – and they should be ready to engage in conversations on this topic, especially around preferred payment/collection methodologies to be used when setting up these services for end customers to purchase. Treasurers also have an opportunity to tap into the additional data generated as a result of as-a-service models, as well as thinking of new ways to invest excess cash derived from these activities.”

Turning payments into revenue

Talk of increased revenue opportunities brings us to the third megatrend: payments as a revenue driver. While payments have traditionally been considered a source of friction and cost, Lubell believes the tide is turning – they are becoming a huge enabler. “Through the advent of fintechs, and the growth of e-commerce platforms, online portals, e-wallets, embedded finance and instant payments, companies are now able to pivot their business models and connect to more customers in more locations, with extended propositions.”

In short, payments have become a lever for improved customer experience, an opportunity for new revenue streams, and a linchpin for companies to succeed in this era of digital living, believes Lubell. Attention should therefore be turned, she suggests, to perfecting the organisation’s payments strategy in 2022.

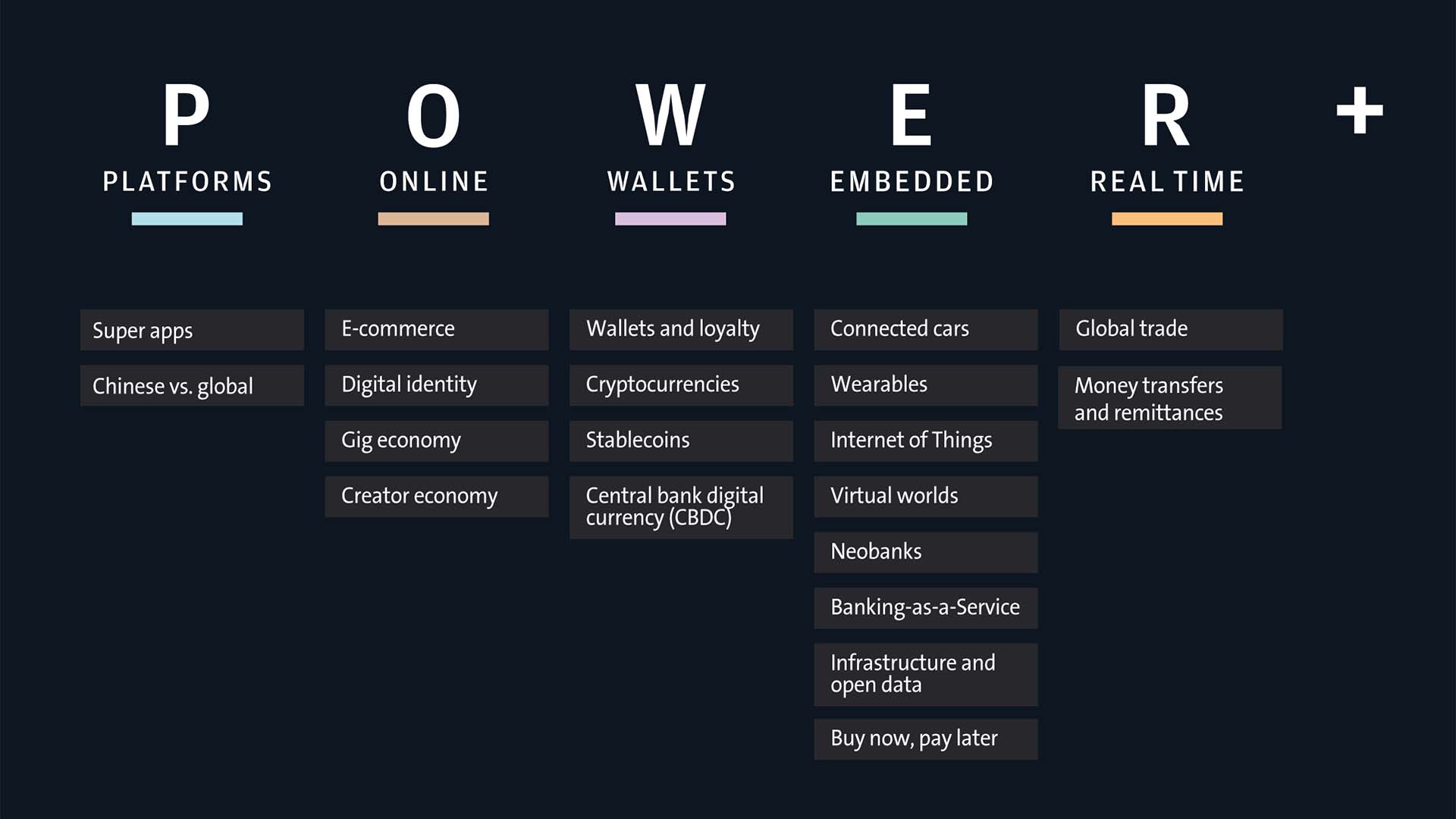

Here, Lubell refers to a whitepaper written by her colleagues, entitled ‘Payments are Eating the World’.[1] “In this epic piece of research, we outline J.P. Morgan’s proprietary POWER+ framework [see fig. 1] which focuses on the mega-themes that are shaping the future of payments. We also explain practical ways for companies to get ahead of these important developments.” To add some context, these mega-themes account for circa $54tr. in global payment flows – and this figure will only continue to grow.

FIG 1

While treasurers might not have a say over all of these POWER+ aspects, there are many that they can influence or prepare for. Instant payments are a great example, according to Lubell. “Of course, there are benefits on the collections side – such as faster cash application and finality of funds. But on the payments side, there can be huge benefits too, ranging from the shift away from batch processing to the ability to hold on to, and therefore invest, cash for longer. This is the treasurer’s tool for advancing the user experience agenda. And as instant payment schemes expand, and blockchain payments become more mainstream, real-time payments, and related capabilities such as Request to Pay, are likely to become commonplace for B2C and B2B treasury teams.”

Lubell also flags cryptocurrencies as being highly relevant for treasury leaders in 2022. “It’s impossible to ignore cryptocurrencies, stablecoins and central bank digital currencies [CBDCs],” she says. “Yes, treasurers are typically risk-averse and aren’t likely to be using cryptocurrencies at work anytime soon, but the world is changing. It’s important to be ready for questions from the C-suite on these topics, and to have a game plan for adapting to a world where CBDCs are no longer limited to small pilot schemes.”

Back to reality

While it might seem like a leap to transition from cryptocurrencies to days sales outstanding, the fourth megatrend for 2022 is aligning working capital and liquidity. “This is practically the treasurer’s mantra already,” quips Lubell. “Every good treasury professional knows that working capital and liquidity are the backbone of the organisation, and the building blocks for sustainable growth. What’s new, though, is the dynamism of the environment we are now operating in, and how quickly it can change.”

Of course, not every corporate will be laser-focused on working capital optimisation in 2022. Those companies that have already successfully pivoted towards e-commerce, or are cash rich, may instead be looking more towards investment and growth opportunities. But for those that are cash poor, releasing working capital trapped in internal processes and improving overall cash visibility will be mission critical.

Thankfully, the range of working capital and liquidity tools available in the market is evolving as rapidly as the operating environment. Automation is a key area of development, with RPA – often in combination with APIs – offering significant opportunities to improve data collection within treasury. In turn, this can lead to a tighter grip on cash positions, without the manual workload or room for human error. Meanwhile, AI and ML add an extra layer on top of this data, enabling treasury teams to run multiple cash forecasting scenarios and analyses at the touch of a button.

Automated and intelligent solutions in other areas of the business can also help treasury to shore up its working capital foundations, continues Lubell. “Smart factories, for example, can continually pass data back along the chain to treasury so they know in real time when inventories will be replenished and supplier payments will need to be made – rather than waiting for paperwork to land in their inbox or on their desk.” It’s about enabling treasury to be much more proactive, not just reactive.

On the subject of suppliers, Lubell says that supply chain finance (SCF) is also maturing. “Large buyers can now tailor SCF programmes to much better suit the needs of their suppliers – and to reach all sizes of suppliers. Increasingly, we are also seeing ESG criteria being built into SCF programmes, whereby buyers reward sustainable behaviour from suppliers with more favourable financing rates,” she says. The latter offers significant ‘wins’ for all parties, not to mention the planet, and it’s certainly something that Lubell expects to see more of in 2022 as ESG extends to the business ecosystem, not just single organisations.

Going beyond green

In fact, sustainability has become so integral to the modern workplace that Lubell identifies this as the fifth and final megatrend for this year: Addressing ESG agendas. “While ESG is coming as a top-down directive, without treasurers, it won’t be fully embodied. Treasury professionals are becoming a powerful force in all aspects of ESG – moving beyond green bonds to sustainable cash management and investment solutions, improved corporate governance, and employee wellbeing,” says Lubell.

As the appetite for solutions across the three facets of ESG grows, banks are responding with increasingly innovative solutions. “There are many great ESG products available for treasurers now, but the market is still maturing. Treasury teams are also looking for ways to meet specific internal KPIs related to ESG, and we are partnering with them to support these goals and innovate together.”

As much as internal KPIs are part of ESG success, Lubell also sees more involvement from external agencies in 2022 – especially ratings agencies and sustainability consultancies. “When we talk about ESG, we have to acknowledge the notion of greenwashing, as this does sadly happen in some organisations. Over the coming year, I expect to see more external, independent, validation of ESG activities – including SCF programmes – and this will only lend credibility and greater momentum to ESG within the treasury function.”

Come together

While these five megatrends provide a roadmap to help treasurers successfully navigate the year ahead, they should not be viewed in isolation, cautions Lubell. “There is interplay between the trends, meaning that a joined-up approach is necessary. In 2022, treasurers will be – more than ever – acting as connectors in the business. Not only will they be drawing together business trends and interpreting the impact on cash positions, but they must also act as the bridge between numerous departments, ranging from IT to procurement, legal, business payments, marketing and the C-suite,” she believes. “Everything is connected – and the treasurer has the opportunity to sit at the heart of all of this business transformation.”

Lubell has over 14 years’ financial services experience stemming from various leadership roles held at J.P. Morgan, Citi, and American Express. Her expertise in product management, marketing, commercialisation, and strategy has been honed while working at these global brands, as well as during her time as a principal consultant for PwC and marketing manager for L’Oreal, USA.

Although a keen hiker who has summited Mount Kilimanjaro and Mount Everest Base Camp, these days Lubell spends more time on urban safari in New York City.